At SmartCapitalMind, we're committed to delivering accurate, trustworthy information. Our expert-authored content is rigorously fact-checked and sourced from credible authorities. Discover how we uphold the highest standards in providing you with reliable knowledge.

What is the Keynesian Multiplier?

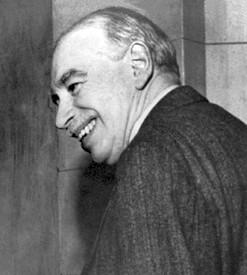

The Keynesian multiplier is an economic theory that states that spending generates more spending, ultimately to the benefit of the economy as a whole. The theory was proposed by economist Richard Kahn in the 1930s, as an integral component of John Maynard Keynes' more sweeping work, The General Theory of Employment, Interest and Money. Modern economists are far from united on the validity of either Kahn's or Keynes' work. The Keynesian multiplier and Keynes' entire approach are widely discounted as remnants of discredited central economic planning by governments. Their influence persists, however, among some economists and economic schools of thought.

An example of how the Keynesian multiplier is supposed to work might consist of a manufacturer that moves into a new community and injects $100,000 US Dollars into the local economy by purchasing goods from local merchants. If this new company spends $40,000 USD with company A, $35,000 USD with company B and $25,000 USD with company C, the multiplier effect predicts that companies A, B and C will in turn spend a certain percentage of their new income with three more companies, which also will spend part of their new income. If each company spends half of their new income, aggregate economic activity would increase by the total spent. In this example, the increased activity is the original $100,000 USD, plus $20,000 USD by company A, plus $17,500 USD by company B plus $12,500 USD by company C. The point of the Keynesian multiplier is that economic activity is not increased merely by the original $100,000 USD but by an ever-increasing total, which is $150,000 USD-plus in this example.

Economic critics disagree on several grounds. The gist of their criticism is that the Keynesian multiplier makes presumptions about economic behavior that are demonstrably untrue. If, for example, spending actually multiplied economic activity, then a spending injection of only a limited amount could generate an unlimited increase in activity — like an economic perpetual motion machine. Instead, empirical studies have yielded multiplier effects of less than 1, suggesting that rather than multiply spending or even increasing it, centralized injections of spending crowd out other economic activity.

As a perhaps exaggerated example of his belief in the effect of the multiplier, Keynes suggested that governments could simply bury currency in the ground and lease out the right to dig it up. The result would be full employment and capital appreciation. His detractors consider any such nonproductive activity completely in error.

AS FEATURED ON:

AS FEATURED ON:

Discussion Comments

Keynes's multiplier is a mathematical identity consisting of a consumption function series equaling the reciprocal of the savings function, and is utterly useless in spite of sounding very learned.

Post your comments